Ledger Live, the companion application for Ledger hardware wallets (Nano S Plus, Nano X, Flex, or Stax), does not natively support managing liquidity pool positions directly within its interface. This means you cannot add, remove, or monitor liquidity pool positions (e.g., providing liquidity to decentralized exchanges like Uniswap or SushiSwap) solely through Ledger Live.

However, you can securely manage the assets involved in liquidity pools and interact with DeFi protocols that handle liquidity pools by integrating your Ledger device with external tools like MetaMask or WalletConnect-compatible dApps.

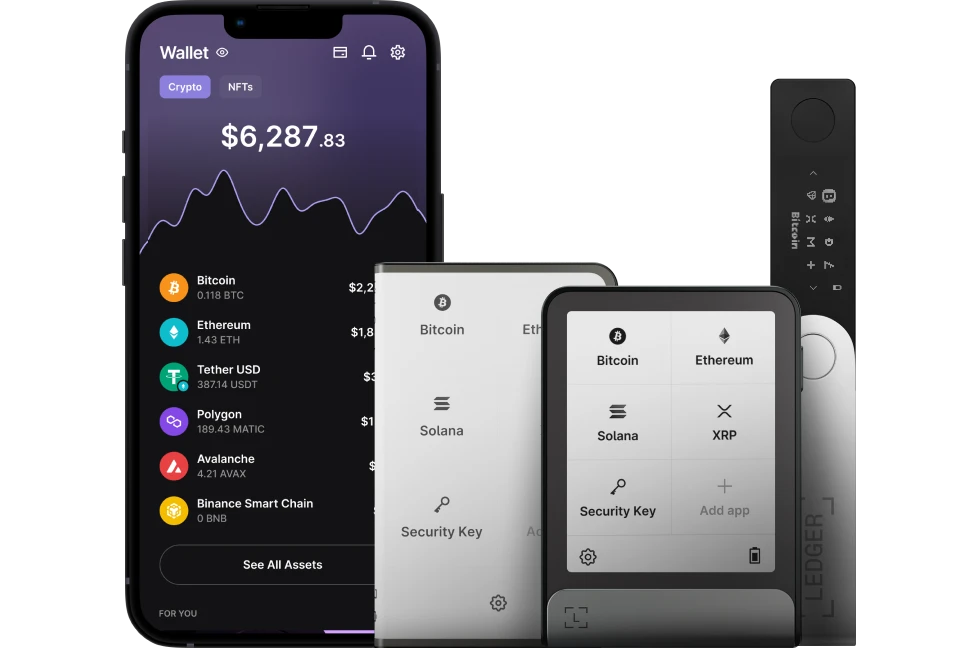

Please download the last update of Ledger Live Application:

1. Ledger Live for Windows 10/11

2. Ledger Live for MAC

3. Ledger Live for Android

Below, I’ll guide you through how to manage liquidity pool positions using Ledger Live in conjunction with these tools, focusing on security and practicality.

Why Ledger Live Doesn’t Manage Liquidity Pools Directly

- Focus: Ledger Live is designed for securely managing cryptocurrency assets (over 5,500 coins and tokens), offering features like buying, selling, swapping, staking, and basic portfolio tracking—not for managing complex DeFi activities like liquidity pools.

- DeFi Scope: Native DeFi support in Ledger Live is limited to staking (e.g., ETH via Lido), lending (e.g., Compound), and swapping (e.g., Paraswap)—liquidity pool management requires external smart contract interactions not built into the app.

- Security: Your Ledger’s private keys stay offline, requiring external dApps to handle pool-related transactions while Ledger signs them securely.

Step-by-Step Guide to Managing Liquidity Pool Positions

Step 1: Set Up Your Ledger and Ledger Live

- Install Ledger Live:

- Download from ledger.com/ledger-live (desktop or mobile) and update to the latest version (e.g., 2.81.0).

- Connect Your Ledger:

- Use USB (all models) or Bluetooth (Nano X), unlock with your PIN.

- Add an Account:

- Go to Accounts > Add Account, select the blockchain for your pool (e.g., “Ethereum” for ETH/USDT pools).

- Install the app on your Ledger via My Ledger (e.g., Ethereum app)—approve on-device.

- Sync and name it (e.g., “ETH DeFi”).

Step 2: Prepare Assets for Liquidity

- Fund Your Wallet: Ensure you have the assets for your pool (e.g., 0.5 ETH and 1,500 USDT for a 50/50 Uniswap pool):

- In Ledger Live, click Receive, verify the address on your Ledger, send assets from an exchange or another wallet.

- Gas Funds: For Ethereum-based pools, keep extra ETH (e.g., 0.01–0.05 ETH) for gas fees—check rates on etherscan.io.

Step 3: Connect Ledger to a DeFi Platform

Since Ledger Live doesn’t manage pools, use MetaMask or WalletConnect to interact with a decentralized exchange (DEX).

- Option 1: MetaMask (Broader Compatibility):

- Install MetaMask (metamask.io, browser extension).

- Connect Ledger:

- Click Connect Hardware Wallet > Ledger, unlock your Ledger, open the Ethereum app, select your address (e.g., 0x123…).

- Verify it matches Ledger Live (Accounts > Ethereum > Receive).

- Open a DEX:

- Visit app.uniswap.org, click Connect Wallet > MetaMask.

- Option 2: WalletConnect (Ledger Live Native):

- In Ledger Live, go to Accounts > Ethereum > WalletConnect.

- On the DEX (e.g., app.sushi.com), click Connect Wallet > WalletConnect—get a QR code.

- Desktop: Paste the QR into Ledger Live’s WalletConnect window. Mobile: Scan with Ledger Live mobile.

- Approve connection on your Ledger.

Step 4: Add Liquidity to a Pool

- Select Pool:

- On the DEX (e.g., Uniswap), go to Pool > Add Liquidity.

- Choose your pair (e.g., ETH/USDT), input amounts (e.g., 0.5 ETH + 1,500 USDT)—must be 50/50 value for most AMMs.

- Approve Tokens:

- Approve each token (e.g., “Approve USDT”)—sign on your Ledger (e.g., “Contract: 0xdAC17…”, “Amount: 1,500 USDT”).

- Deposit:

- Click Supply, review pool share (e.g., 1% of ETH/USDT pool), sign on Ledger (e.g., “Add Liquidity: 0.5 ETH, 1,500 USDT”).

- Receive LP Tokens:

- Get liquidity provider (LP) tokens (e.g., UNI-V2 ETH/USDT)—an ERC-20 token representing your pool share.

Step 5: View LP Tokens in Ledger Live

- In Ledger Live:

- Go to Accounts > Ethereum > Tokens.

- LP tokens appear (e.g., “UNI-V2: 0.5”)—syncs automatically if sent to your Ledger address.

- Note: Rewards (e.g., trading fees) accrue in the pool, not Ledger Live—track via the DEX or tools like apy.vision.

Step 6: Manage and Monitor Your Position

- Check Position:

- On the DEX (e.g., Uniswap Pool tab), connect your Ledger-linked wallet—see your share, fees earned, and impermanent loss (IL).

- Use pools.fyi or debank.com—input your Ledger’s public address for detailed analytics.

- Adjust Position:

- Add more liquidity: Repeat Step 4.

- Remove partially: Go to Remove Liquidity, select percentage, sign on Ledger—get back proportional ETH/USDT.

- Track in Ledger Live: Exported fees or withdrawn assets appear in Accounts > History.

Step 7: Remove Liquidity

- Withdraw:

- On the DEX, go to Pool > Remove Liquidity.

- Select LP token amount (e.g., 50%), click Remove, sign on Ledger (e.g., “Remove 0.25 UNI-V2”).

- Receive assets (e.g., 0.24 ETH + 740 USDT, adjusted for IL).

- Verify in Ledger Live:

- Assets return to Accounts > Ethereum and Tokens—sync to confirm.

Security Best Practices

- Verify DEX: Use official URLs (e.g., app.uniswap.org)—avoid phishing scams (see “Avoiding Phishing Scams”).

- Never Share Seed: Your 24-word phrase stays on your Ledger—don’t enter it anywhere (see “Why Never Share Your Seed”).

- Check Contracts: Confirm smart contract addresses (e.g., Uniswap Router: 0x7a250d…) on etherscan.io—avoid malicious ones.

- Sign Safely: Always verify transaction details on your Ledger’s screen—prevents malware swaps (see “Verifying Transactions”).

- Update: Keep Ledger Live, blockchain apps (e.g., Ethereum), and firmware current (My Ledger > Firmware).

Minimizing Risks (e.g., Impermanent Loss)

- Stable Pairs: Use low-volatility pairs (e.g., USDT/USDC)—reduces IL (see “Avoiding Impermanent Loss”).

- High Fees: Choose pools with high trading volume—fees offset IL (e.g., 0.3% per trade on Uniswap).

- Monitor: Regularly check IL on apy.vision—withdraw if losses outweigh rewards.

Example

- Pool: ETH/DAI on Uniswap.

- Add: Deposit 0.5 ETH + 1,500 DAI via MetaMask + Ledger—get UNI-V2 tokens in Ledger Live.

- Monitor: Earn $5 in fees over a week—track on Uniswap.

- Remove: Withdraw 50%—sign on Nano X, get 0.24 ETH + 740 DAI back in Ledger Live.

Conclusion

While Ledger Live doesn’t directly manage liquidity pool positions, it pairs seamlessly with MetaMask or WalletConnect to let you add, monitor, and remove liquidity on DEXs like Uniswap—keeping your assets secure with Ledger’s offline signing. Set up your Ethereum account, connect to a trusted platform, and verify every step on your Ledger for a safe DeFi experience. For real-time pool analytics or IL tracking, supplement with external tools.