Exporting your transaction history from Ledger Live for tax reporting is a straightforward process, though it comes with some limitations to keep in mind. Ledger Live allows you to generate a CSV file of your transaction history, which you can then use for tax purposes—either manually or with crypto tax software.

Please download the last update of Ledger Live Application:

1. Ledger Live for Windows 10/11

2. Ledger Live for MAC

3. Ledger Live for Android

Below, I’ll walk you through the steps, highlight key considerations, and suggest how to make it tax-ready.

How to Export Transaction History in Ledger Live

- Open Ledger Live:

- Launch the Ledger Live desktop app (this feature is only available on desktop, not mobile). Ensure it’s updated to the latest version via the official Ledger website (ledger.com).

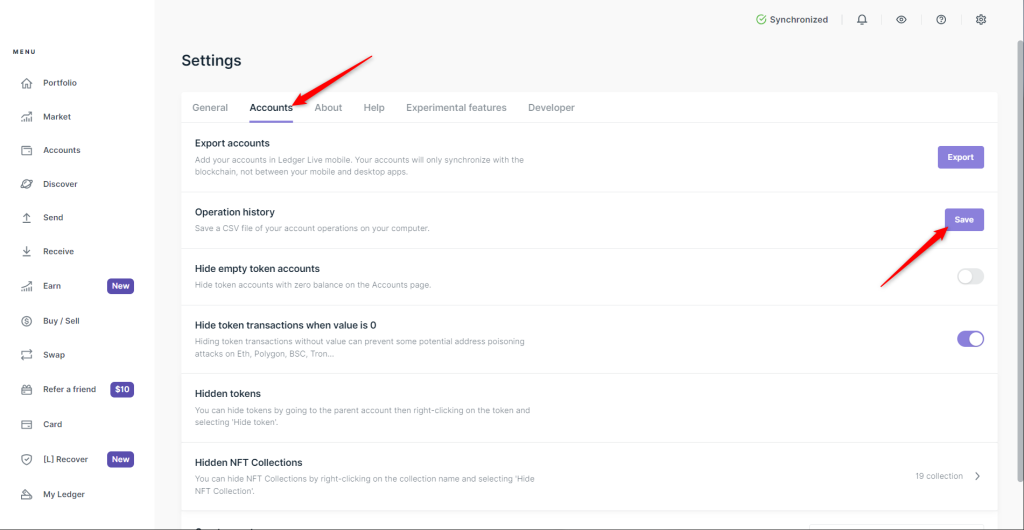

- Go to Settings:

- Click the gear icon in the top-right corner to access “Settings.”

- Navigate to Accounts:

- In the Settings menu, select the “Accounts” tab.

- Export Operation History:

- Scroll to the “Operation History” section.

- Click “Save” or “Export” (the exact label may vary slightly with updates).

- A window will pop up allowing you to select which accounts to include (e.g., Bitcoin, Ethereum, etc.). Check the boxes for the accounts you want to export.

- Save the CSV File:

- Click “Save” again, then choose a location on your computer to store the file.

- Ledger Live will generate a CSV file containing your transaction history for the selected accounts.

What’s Included in the CSV

The exported CSV typically includes:

- Transaction date and time

- Transaction type (e.g., sent, received)

- Amount and currency (e.g., 0.5 BTC)

- Transaction ID (hash)

- Sender/receiver addresses

- Fees (if applicable)

However, it does not include:

- Fiat values at the time of each transaction (e.g., USD equivalent when you sent 1 ETH).

- Cost basis or capital gains/losses, which are critical for tax reporting.

Key Considerations for Tax Reporting

- Not Tax-Optimized: Ledger Live explicitly notes that this export isn’t designed for precise tax reporting. It provides raw blockchain data, not tax-specific calculations like gains or losses. For that, you’ll need additional tools or manual work.

- Sync Your Ledger: Before exporting, connect your Ledger device and sync your accounts to ensure all recent transactions are included. Clear the cache (Settings > Help > Clear) if data seems incomplete.

- Missing Transactions: If some transactions don’t appear, use a blockchain explorer (e.g., Etherscan for Ethereum, Blockchain.com for Bitcoin) to cross-check and retrieve missing data by entering your public address.

- Multi-Chain Support: The export covers all supported chains (e.g., BTC, ETH, SOL), but you’ll need to verify each account’s data if you hold assets across multiple blockchains.

Making It Tax-Ready

Since the Ledger Live CSV isn’t enough on its own for tax filing, here’s how to prepare it:

- Manual Calculation:

- Open the CSV in a spreadsheet (e.g., Excel, Google Sheets).

- Add columns for fiat value at the transaction date (use historical price data from sites like CoinMarketCap or CoinGecko), cost basis, and proceeds.

- Calculate gains/losses for each taxable event (e.g., selling, trading). This is time-consuming and error-prone.

- Crypto Tax Software:

- Import the CSV into a tax platform like CoinLedger, Koinly, CoinTracking, or Divly. These tools:

- Match transactions with historical prices.

- Calculate capital gains/losses and income (e.g., from staking).

- Generate tax forms (e.g., IRS Form 8949 for the U.S.).

- Steps:

- Sign up for a tax service.

- Upload the Ledger Live CSV (look for a “Ledger Live Import” option).

- Add any missing transactions (e.g., from exchanges) manually or via API.

- Review and download your tax report.

- Many of these platforms integrate directly with Ledger Live or blockchain explorers, pulling data via public addresses if you prefer skipping the CSV step.

- Import the CSV into a tax platform like CoinLedger, Koinly, CoinTracking, or Divly. These tools:

- Passphrase Accounts: If you use a passphrase (25th word) for hidden accounts, export those separately by accessing them with the passphrase on your Ledger device first, then repeating the export process.

Taxable Events to Watch For

- Sending/Trading: Moving crypto off your Ledger to an exchange and selling it is taxable.

- Receiving Income: Staking rewards or airdrops logged in Ledger Live count as income in most jurisdictions.

- Not Taxable: Transfers between your own Ledger accounts or wallets aren’t taxable, but you should document them for clarity.

Why Ledger Doesn’t Do More

Ledger Live focuses on security and asset management, not tax compliance, because tax rules vary widely by country. It leaves detailed reporting to specialized software or accountants.

Final Tips

- Backup Your Data: Save the CSV securely, as it contains sensitive transaction info.

- Check Local Rules: Tax requirements differ (e.g., U.S. capital gains vs. U.K. CGT vs. no crypto tax in Portugal). Tailor your report accordingly.