Earning interest on stablecoins with Ledger Live is a secure and accessible way to generate passive income on your cryptocurrency holdings while leveraging the robust security of your Ledger hardware wallet (Nano S Plus, Nano X, Flex, or Stax).

Stablecoins—such as USDT (Tether), USDC (USD Coin), and DAI—are cryptocurrencies pegged to stable assets like the US dollar, offering price stability compared to volatile coins like Bitcoin or Ethereum. Ledger Live integrates with lending protocols, notably Compound, to allow you to lend these stablecoins and earn interest directly within the app.

Please download the last update of Ledger Live Application:

1. Ledger Live for Windows 10/11

2. Ledger Live for MAC

3. Ledger Live for Android

Below, I’ll guide you through how to earn interest on stablecoins with Ledger Live, based on its current capabilities.

How It Works

Ledger Live’s lending feature, introduced in November 2020 with Compound integration, enables you to deposit supported stablecoins into Compound’s decentralized lending pools. Compound is a well-established DeFi protocol where lenders supply assets, borrowers pay interest, and you earn a variable Annual Percentage Yield (APY) based on market supply and demand. Your Ledger ensures that private keys remain offline, and every transaction is signed on-device, maintaining top-tier security.

- Supported Stablecoins: USDT, USDC, DAI (as of the latest integration—additional stablecoins may have been added; check Ledger Live for updates).

- Interest Mechanism: You deposit stablecoins and receive cTokens (e.g., cUSDT, cUSDC) representing your lent assets plus accruing interest. The cToken exchange rate increases over time, reflecting your earnings.

- APY: Variable, typically ranging from 2–6% for stablecoins on Compound, though rates fluctuate—real-time APYs are visible in Ledger Live or Compound’s dashboard.

Step-by-Step Guide

Step 1: Set Up Ledger Live and Your Wallet

- Install Ledger Live:

- Download the latest version (e.g., 2.81.0 or newer) from ledger.com/ledger-live for desktop (Windows 10+, macOS 11+, Linux) or mobile (iOS 13+, Android 8+).

- Connect Your Ledger:

- Plug in via USB (all models) or pair via Bluetooth (Nano X)—unlock with your PIN.

- Add an Ethereum Account:

- Go to Accounts > Add Account, select “Ethereum (ETH)” (stablecoins are ERC-20 tokens on Ethereum).

- Install the Ethereum app on your Ledger via My Ledger—approve on-device.

- Sync and name it (e.g., “Stablecoin Lending”).

- Fund Your Account:

- Send stablecoins (e.g., 100 USDC) and ETH (e.g., 0.01–0.05 ETH for gas) to your Ethereum address (Receive, verify on Ledger).

Step 2: Access the Lending Feature

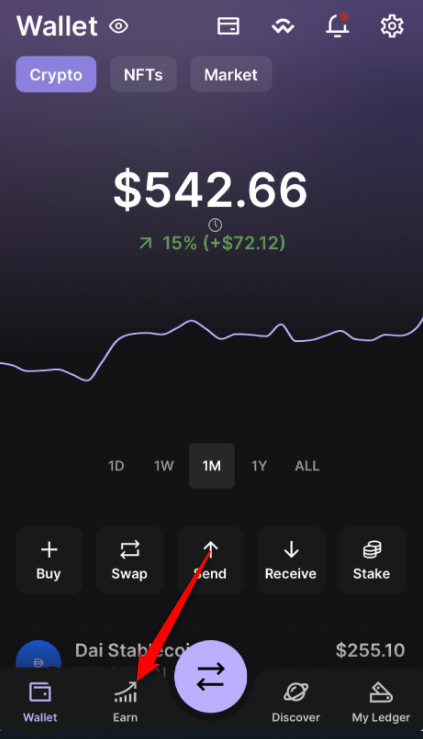

- Navigate to Discover:

- In Ledger Live, click Discover in the sidebar (desktop) or tap it (mobile).

- Select Compound:

- Find and select Compound from the list of dApps—this integration connects you to Compound’s lending protocol.

Step 3: Deposit Stablecoins to Earn Interest

- Choose Your Stablecoin:

- Select the stablecoin you want to lend (e.g., USDC, USDT, DAI)—ensure it’s in your Ethereum account.

- Approve Spending:

- Click Supply, enter the amount (e.g., 100 USDC).

- Approve Compound to access your funds—Ledger Live prompts you to sign this on your Ledger (e.g., “Contract: 0x39AA3…”, “Amount: 100 USDC”).

- Deposit Funds:

- Confirm the deposit transaction—sign again on your Ledger (e.g., “Supply 100 USDC to Compound…”).

- Funds move to Compound’s pool; you receive cTokens (e.g., cUSDC) reflecting your principal plus interest.

- Track Earnings:

- cTokens appear in Accounts > Ethereum > Tokens—their value grows as interest accrues.

- Check real-time APY and balance in Ledger Live’s Compound interface or app.compound.finance.

Step 4: Withdraw Your Funds and Interest

- Withdraw:

- In Discover > Compound, select your supplied asset (e.g., cUSDC).

- Click Withdraw, choose the amount (e.g., 50 cUSDC or all), sign on your Ledger.

- Receive Assets:

- Get back USDC plus accrued interest (e.g., 102 USDC after a month at 2% APY)—updates in Accounts > Ethereum > Tokens.

Current APY Estimates

- USDC: 2–4% APY (stable, widely used).

- USDT: 2–5% APY (similar demand, slight variance).

- DAI: 1–3% APY (lower due to over-collateralization mechanics).

- Note: APYs are variable—supply/demand shifts on Compound affect rates. Check Ledger Live > Discover > Compound or Compound’s site for live data.

Security Best Practices

- Verify Source: Use only ledger.com/ledger-live for the app—avoid phishing clones (see “Avoiding Phishing Scams”).

- Never Share Seed: Your 24-word recovery phrase stays on your Ledger—don’t enter it anywhere (see “Why Never Share Your Seed”).

- Check Transactions: Confirm contract addresses (e.g., Compound USDC: 0x39AA3…) and amounts on your Ledger’s screen—prevents malware swaps (see “Verifying Transactions”).

- Gas Funds: Keep ETH for fees—e.g., 0.01 ETH per transaction (check etherscan.io).

- Update Software: Ensure Ledger Live, Ethereum app, and firmware are current (My Ledger > Firmware).

Limitations

- Manual Withdrawal: Interest accrues automatically, but withdrawing profits or reinvesting requires manual action—Ledger Live doesn’t auto-compound beyond cToken growth.

- Supported Stablecoins: Limited to USDT, USDC, DAI via Compound—other stablecoins (e.g., BUSD) need external dApps like Aave with MetaMask.

- Gas Costs: Ethereum fees apply—e.g., $5–$20 per deposit/withdrawal—consider timing (low gas periods) or L2 solutions (future integration possible).

Alternative for Broader Options

- MetaMask + Ledger: Connect your Ledger to MetaMask (metamask.io) for access to more lending platforms (e.g., Aave, Yearn)—see “Using Ledger Live with MetaMask”. Example: Lend USDT on Aave for 2–6% APY, sign via Ledger.

Example

- Deposit: Lend 200 USDC via Discover > Compound—sign on Nano X.

- Earnings: After 1 month at 3% APY, your cUSDC reflects ~206 USDC.

- Withdraw: Redeem all—get 206 USDC back in Ledger Live.

Conclusion

Earning interest on stablecoins with Ledger Live is straightforward via Compound integration—set up your Ethereum account, deposit USDT/USDC/DAI, and watch your cTokens grow with variable APYs (typically 2–6%). Your Ledger’s offline security ensures safety, though withdrawals are manual, and gas fees apply. For broader options, pair with MetaMask. Check Discover > Compound for live rates and start lending securely.