Ledger Live, the companion app for Ledger hardware wallets (Nano S Plus, Nano X, Flex, or Stax), supports staking for a variety of cryptocurrencies, allowing you to earn passive income securely while keeping your private keys offline.

However, staking returns—measured as Annual Percentage Yield (APY) or Annual Percentage Rate (APR)—vary significantly across supported coins due to differences in network protocols, validator performance, staking mechanics, and market conditions.

Please download the last update of Ledger Live Application:

1. Ledger Live for Windows 10/11

2. Ledger Live for MAC

3. Ledger Live for Android

Below, I’ll compare staking returns across Ledger Live’s supported coins, based on the latest available data, noting that exact APYs fluctuate and should be verified in real-time within the app.

Supported Coins for Staking in Ledger Live

Ledger Live enables staking for the following coins natively through its Earn section, typically via Ledger-operated validators or trusted partners like Lido and Kiln:

- Ethereum (ETH) via Lido

- Solana (SOL)

- Cardano (ADA)

- Polkadot (DOT)

- Tezos (XTZ)

- Cosmos (ATOM)

- Tron (TRX)

- Near Protocol (NEAR)

Other coins (e.g., Avalanche, Algorand) may be stakeable with Ledger hardware but require third-party wallets (e.g., MetaMask, Algo Wallet), not direct Ledger Live integration—those won’t be covered here.

Staking Returns Comparison

Here’s a breakdown of staking returns for Ledger Live’s natively supported coins, based on typical APYs reported by Ledger and industry sources like Staking Rewards, CoinGecko, and Ledger’s documentation. Note: APYs are averages and can vary due to network conditions, validator commissions, and staking demand—check Ledger Live > Earn for real-time rates.

| Coin | Typical APY Range | Reward Frequency | Lock-Up Period | Key Notes |

| Ethereum (ETH) | 3–5% | Daily (via stETH) | None (liquid) | Staked via Lido—rewards accrue as stETH, auto-compounding, no lock-up. |

| Solana (SOL) | 5–7% | Every 2–3 days | ~2 days unbonding | Delegated to validators—rewards auto-deposit, manual restaking needed. |

| Cardano (ADA) | 2–4% | Every 5 days | None | Rewards auto-add to wallet—manual restaking for compounding. |

| Polkadot (DOT) | 10–13% | Every 7 days | 28 days unbonding | High yield but long lock-up—requires careful planning. |

| Tezos (XTZ) | 5–7% | Every 3 days | None | Liquid staking—rewards auto-delegate via validator, easy to compound. |

| Cosmos (ATOM) | 15–20% | Every 7 days | 21 days unbonding | High APY, higher risk (slashing possible)—long unbonding period. |

| Tron (TRX) | 3–5% | Every 3–7 days | 3 days unbonding | Simple staking—moderate returns, short lock-up. |

| Near (NEAR) | 8–11% | Every 12 hours | ~2 days unbonding | High frequency rewards—solid yield with quick access post-unstaking. |

Detailed Comparison Factors

- APY Range:

- Highest Returns: Cosmos (15–20%) and Polkadot (10–13%) lead due to higher network incentives and staking demand, though they come with longer lock-ups and potential slashing risks ( Cosmos).

- Moderate Returns: Solana (5–7%), Tezos (5–7%), and Near (8–11%) offer a balance of decent yields and shorter unbonding periods.

- Lower Returns: Ethereum (3–5%), Cardano (2–4%), and Tron (3–5%) provide stability and lower risk, appealing to conservative stakers.

- Volatility Impact: APYs are in crypto terms—fiat value fluctuates with coin prices (e.g., a 20% ATOM drop could offset a 15% APY).

- Reward Frequency:

- Fastest: Near (12 hours) and Ethereum (daily via stETH) suit frequent reward tracking.

- Moderate: Solana (2–3 days), Tezos (3 days), Tron (3–7 days), Cardano (5 days)—manageable for periodic checks.

- Slowest: Polkadot and Cosmos (7 days)—less frequent, but higher yields compensate.

- Lock-Up Period:

- None: Ethereum (liquid via Lido), Cardano, Tezos—maximum flexibility.

- Short: Solana (2 days), Near (2 days), Tron (3 days)—quick access post-unstaking.

- Long: Polkadot (28 days), Cosmos (21 days)—higher commitment, less liquidity.

- Mechanics and Risks:

- Liquid Staking: Ethereum (stETH) and Tezos allow immediate use of staked assets—low risk, high flexibility.

- Slashing Risk: Cosmos and Polkadot validators may penalize downtime or misbehavior—choose reliable validators (Ledger’s are trusted).

- Ease: Cardano and Tron auto-add rewards—simplest for beginners.

How to Compare in Ledger Live

- Check APYs:

- Open Ledger Live, connect your Ledger, go to Earn.

- Select a coin (e.g., “Stake SOL”)—view estimated APY (e.g., 6%) and validator details.

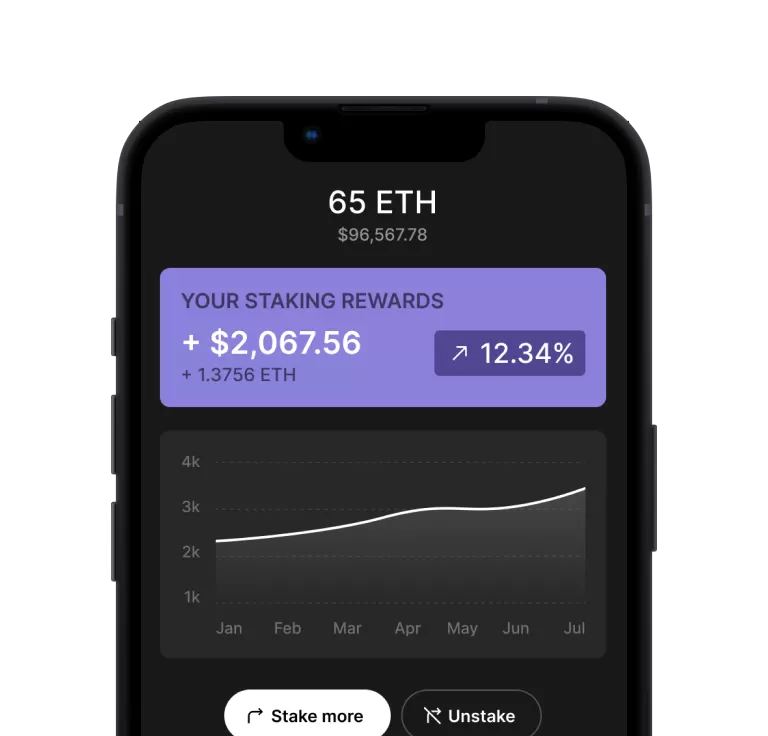

- Track Rewards:

- Earn Dashboard: Shows staked amount, rewards earned, and frequency—e.g., “0.05 SOL earned this epoch.”

- History: Logs reward deposits (e.g., “Received 0.008 ADA”).

- Cross-Verify:

- Use explorers (e.g., solscan.io, cardanoscan.io) with your address (Receive) to confirm on-chain rewards match Ledger Live.

Strategic Insights

- Best for High Returns: Cosmos and Polkadot—if you can handle lock-ups and monitor validators.

- Best for Flexibility: Ethereum (Lido) and Tezos—liquid staking with no lock-up, ideal for active traders.

- Best for Beginners: Cardano and Tron—simple, low-risk, auto-reward systems.

- Best Balance: Solana and Near—solid APYs, short unbonding, frequent rewards.

Limitations

- Manual Compounding: Except for Ethereum (stETH), rewards don’t auto-reinvest—restake manually in Earn (see “Automating Staking Rewards”).

- Dynamic APYs: Rates drop as more users stake (e.g., SOL’s 5–7% was 8% in 2023)—check real-time data.

- No Full Automation: Ledger Live lacks scheduled restaking—use external dApps (e.g., Marinade for SOL) for auto-compounding.

Conclusion

Staking returns across Ledger Live’s supported coins range from 2% (ADA) to 20% (ATOM), balancing yield, risk, and liquidity. Ethereum and Tezos offer liquid, low-risk options, while Cosmos and Polkadot reward higher commitment with top APYs. Solana and Near strike a middle ground. Your choice depends on goals—max yield (ATOM/DOT), flexibility (ETH/XTZ), or ease (ADA/TRX). Open Ledger Live’s Earn tab to see current APYs and start staking securely—your Ledger keeps it safe.