Ledger Live does not directly support providing liquidity to decentralized finance (DeFi) protocols or managing liquidity pools—like you would on platforms such as Uniswap, SushiSwap, or PancakeSwap—where impermanent loss (IL) is a common concern.

Instead, Ledger Live focuses on securely managing your cryptocurrency assets (over 5,500 supported coins and tokens) with your Ledger hardware wallet (Nano S Plus, Nano X, Flex, or Stax), offering features like swapping, staking, and basic portfolio tracking. To provide liquidity and avoid impermanent loss while still using your Ledger for security, you’ll need to connect it to a third-party DeFi platform.

Please download the last update of Ledger Live Application:

1. Ledger Live for Windows 10/11

2. Ledger Live for MAC

3. Ledger Live for Android

Below, I’ll explain what impermanent loss is, why it doesn’t apply directly in Ledger Live, and how to minimize it when using your Ledger with external liquidity pools.

What Is Impermanent Loss?

- Definition: Impermanent loss occurs when you provide liquidity to a pool (e.g., ETH/USDT on Uniswap) and the price of the paired assets diverges. The value of your pooled assets may be less than if you’d simply held them, due to arbitrage rebalancing the pool.

- Example: You deposit 1 ETH ($3,000) and 3,000 USDT into a 50/50 pool. If ETH rises to $4,000, the pool adjusts—your share might now be 0.87 ETH and 3,480 USDT ($6,960 total), vs. $7,000 if you’d held (1 ETH + 3,000 USDT). The $40 difference is IL.

- Impermanent: Loss becomes “permanent” only if you withdraw during divergence—holding until prices realign can mitigate it.

Why Ledger Live Doesn’t Involve Impermanent Loss Directly

- No Liquidity Pools: Ledger Live doesn’t let you deposit assets into automated market maker (AMM) pools like Uniswap or Curve—it’s a wallet management tool, not a DeFi platform.

- Supported Features:

- Swapping: Via partners (e.g., Changelly)—simple trades, no pooling, no IL.

- Staking: For coins like ETH (via Lido), SOL, or ADA—single-asset staking avoids IL since you’re not pairing assets.

- Conclusion: IL isn’t a risk within Ledger Live itself—you’d only encounter it by using your Ledger with external DeFi apps.

How to Provide Liquidity Securely with Ledger and Avoid IL

To manage liquidity pools while keeping your assets secured by your Ledger, connect it to a DeFi platform. Here’s how to do it and minimize impermanent loss:

Step 1: Set Up Your Ledger with a DeFi Wallet

- Install MetaMask (or another wallet like MyEtherWallet):

- Download from metamask.io (browser extension)—avoid fakes.

- Connect Your Ledger:

- Open MetaMask, click Connect Hardware Wallet > Ledger.

- Connect your Ledger via USB (or Bluetooth for Nano X), unlock with PIN, open the Ethereum app.

- Select your Ethereum account (e.g., 0x123…)—MetaMask links to it.

- Verify: Check your address in Ledger Live (Accounts > Ethereum > Receive) matches MetaMask—ensures security.

Step 2: Choose a Liquidity Pool

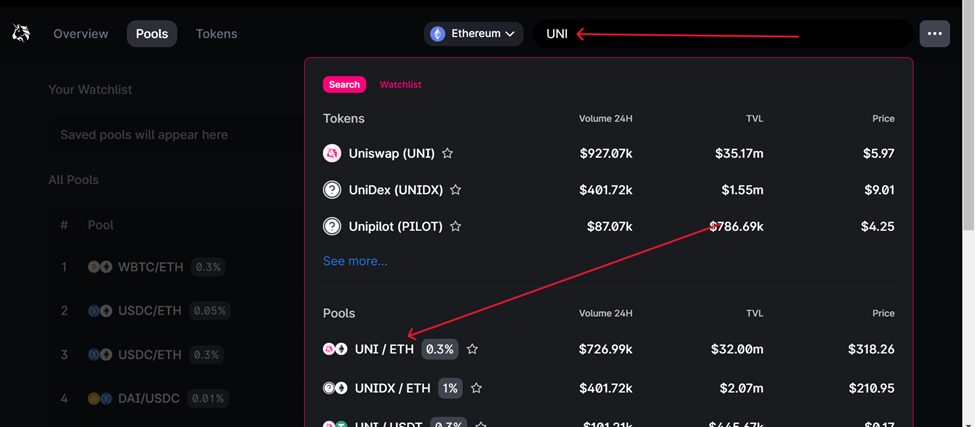

- Platforms: Uniswap (Ethereum), SushiSwap, PancakeSwap (BSC), or QuickSwap (Polygon)—all compatible with Ledger via MetaMask.

- Pairs: Select assets to pool (e.g., ETH/USDT, DAI/USDC).

- Research: Check pool details on app.uniswap.org—look at volume, fees (e.g., 0.3%), and price stability.

Step 3: Minimize Impermanent Loss

- Stablecoin Pairs: Pair assets with low volatility (e.g., USDT/USDC, DAI/USDC):

- Why: Prices stay close (e.g., $1 vs. $1), reducing divergence and IL.

- Example: 1,000 USDT + 1,000 USDC—minimal IL even if one shifts to $0.99.

- Correlated Assets: Use tokens that move together (e.g., WBTC/renBTC):

- Why: Similar price behavior limits rebalancing losses.

- Low-Volatility Periods: Add liquidity during stable market conditions—check historical volatility on CoinGecko.

- Fee Offset: Pick high-volume pools—trading fees (e.g., 0.3% per swap) can outweigh IL:

- Example: 0.5 ETH/1,500 USDT pool earns $50 in fees, covering a $30 IL.

- Single-Sided Staking: Use platforms like Curve or Balancer with stable pools or single-asset options—less IL risk.

Step 4: Add Liquidity

- Deposit Assets:

- In MetaMask, go to Uniswap (app.uniswap.org), connect your Ledger-linked wallet.

- Select Pool > Add Liquidity, choose your pair (e.g., ETH/DAI).

- Enter amounts (e.g., 0.5 ETH + 1,500 DAI)—50/50 value required.

- Approve and Sign:

- Approve token spending—sign on your Ledger (e.g., “Approve DAI: 1,500”).

- Confirm deposit—verify details on-device (contract address, amounts).

- Receive LP Tokens: Get liquidity provider (LP) tokens (e.g., UNI-V2 ETH/DAI)—store them securely in your Ledger-protected wallet.

Step 5: Monitor and Audit

- Check in Ledger Live: LP tokens (ERC-20) appear under Accounts > Ethereum > Tokens—e.g., “UNI-V2: 0.5.”

- Track IL: Use tools like apy.vision or pools.fyi—input your pool address to calculate IL vs. holding.

- Export Data: In Ledger Live (Accounts > History > Export), download CSV—note deposits, withdrawals, and fees for auditing (see “Auditing DeFi Transactions”).

Step 6: Withdraw Strategically

- Timing: Remove liquidity when prices realign (e.g., ETH returns to $3,000) to minimize IL.

- Verify: Sign withdrawal on your Ledger—check returned amounts (e.g., 0.48 ETH + 1,520 DAI) match expectations.

- Rebalance: Adjust pool contributions if IL persists—e.g., shift to stablecoin-heavy pairs.

Security Best Practices

- Verify Contracts: Confirm pool addresses on official sites (e.g., uniswap.org)—avoid fake dApps (see “Avoiding Phishing Scams”).

- Never Share Seed: Your 24-word phrase stays on your Ledger—don’t enter it anywhere (see “Why Never Share Your Seed”).

- Gas Fees: Ensure ETH in your wallet for transactions—check gas prices on etherscan.io.

- Update: Keep Ledger Live, Ethereum app, and firmware current (My Ledger > Firmware).

Example

- Pool: ETH/USDT on Uniswap.

- Deposit: 1 ETH ($3,000) + 3,000 USDT using Ledger via MetaMask.

- Scenario: ETH rises to $4,000—IL = $40 (vs. $7,000 holding value).

- Mitigation: Earn $50 in fees—net gain $10. Switch to USDT/USDC next time.

Conclusion

Ledger Live doesn’t expose you to impermanent loss directly since it doesn’t manage liquidity pools. To provide liquidity securely, connect your Ledger to MetaMask and choose stable or correlated pairs on platforms like Uniswap—minimizing IL with low-volatility assets and high-fee pools. Monitor via external tools and withdraw strategically. Your Ledger keeps your keys safe offline, letting you engage in DeFi with confidence.